2022 is shaping up to be another year of growth opportunities for this growing industry. With the Pacific Region’s GDP poised to grow by 4.5%, unemployment falling by 0.5%, businesses upgrading office space requirements, plus rising inflations in response to the COVID-19 pandemic, we see such turbulent activities as opportunities to take advantage of underlying trends.

Gough Recruitment’s real estate industry outlook for 2022 will cover everything from current market trends across Australia, the effects of the pandemic, and areas for growth in the Australian residential market.

Real Estate Trends: The Eye-Opening Statistics

A favourable economic setting for Residential & Commercial Real Estate

Despite the housing market undergoing a significant halt in 2020, the housing and property sector has roared back to life.

By 2021, both Australia and New Zealand underwent a robust BDP growth of 4%, despite the impact of COVID lockdowns in the third and fourth quarter. This was largely thanks to fiscal support and government grants (combined $420bn over 2020/2021), a buoyant housing market and the prioritising of the construction of infrastructure and residential projects. As we look into 2022, central banks forecast a 4.5% growth for Australia and 4.1% growth for New Zealand with the continued support from governments, and gradual opening of borders to migrant workers.

Both Australia and New Zealand can also expect to see further drops in unemployment (by 0.5%), which already is at its lowest record levels.

Increase in Multinational Home Buyers thanks to Overseas Migration

The Australian Federal Government’s population statement recorded a population growth of 2.8% by June 2024 thanks to the borders reopening last December to international students and skilled migrants. Overall, the real estate industry should benefit from 550,000 migrants between 2022-2024.

Property demand for:

- Office Sectors: According to CBRE Research, the incremental office space demand will be c900,000 sqm in Australia, and 120,000 in New Zealand over the next three years. According to the Homes Affairs Migration program report (2019-2020), 72% of skilled migrants (74,000 new office workers) will require 12 sqm of space per employee.

- Retain Spaces: Up to $6.7bn in retail will be generated from overseas migration by the end of 2024.

- Residential: Overseas migration will also lead to a dwelling demand of just over 200,000 new residential spaces by the end of 2024.

Keeping it “Real” on Interest Rates

- Inflation Rates Increase: The “re-opening” phase of the COVID-19 pandemic has led to a surge in consumer demand and lingering supply restrictions. This has resulted in an increase in inflation expectations, such as short-term bond rates to skyrocket.

- Commercial Property is seeing an Inflation Hedge: Commercial properties are becoming more attractive as an asset. This is largely due to the fact that over the long term, market rents will rise with inflation, with short term variations thanks to changes in market fundamentals. This in turn will increase capital values.

Office/Occupier Takes a Stand

As we progress into Q2, we are witnessing robust leasing activity in commercial real estate, suggesting that vacancy rates are peaking and a greater scope for low single digit rent growth. Such activities are expected to remain high throughout 2022 and tighten from 2023 onwards once vacancy contracts.

Evident themes in the market include:

- Positive corporate earnings outlook,

- Elevated job vacancy,

- SME and Government expansion,

- Withdrawal of 331,000sqm.

COVID-19’s Impact on the Property Market

The COVID-19 pandemic has catalysed shifts in the Australian housing market. This has resulted in distinct impacts on the composition of buyers, property investors and the dynamics of the real estate industry. Our real estate industry forecast will cover four of these shifts below:

Australian Home Values rise by 25%- a record high: According to CoreLogic, housing values increased by 24.6% from March 2020 and February 2022. It was estimated that the total value of residential real estate across Australia equalled $9.8 trillion, up from $7.2 trillion at the onset of COVID-19. Meanwhile, the median Australian dwelling value rose from $173,805 to $728,034.

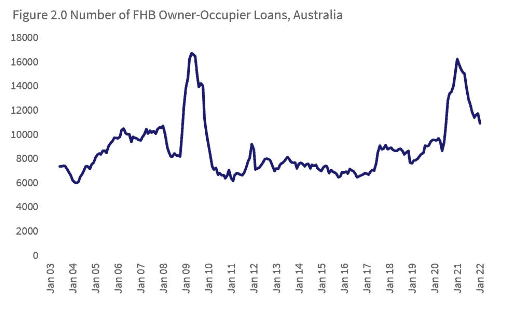

Spike in Homebuyer Activity: The pandemic also resulted in first home buyers taking advantage of affordable housing options following an earlier downturn of low mortgage rates and increased government incentives. As of January 2022, first home buyers home loans equaled 10,964, above the decade average of 8,682. First home buyer lending comprised 24% of owner occupier mortgage demand within this month.

According to the ABS, first home buyer activity surged from June 2020 thanks to the introduction of:

- The HomeBuilder scheme.

- First Home Loan Deposit Scheme.

- State-based grants and stamp duty concessions for first homebuyers.

Rents Rose 11.8% to record highs: While rents did undergo a mild decline between March and August 2020, there was a swift recovery followed by a surge in 2021. Reasons for the spike in rental prices vary:

- The subdued investor activity between 2017 and mid 2020 may have been attributed to rental supply constraints.

- Eroded through the rise of Airbnb services, enabling property owners to pivot towards the short-term rental market.

- Latter trend may have flourished amid the increase of domestic tourism over the two years.

- Higher rents in response to higher purchasing prices for investors.

Over 2021, the annual rent value growth reached its highest levels since 2008. Across the country, the median advertised rent increased from $430 to $470 per week.

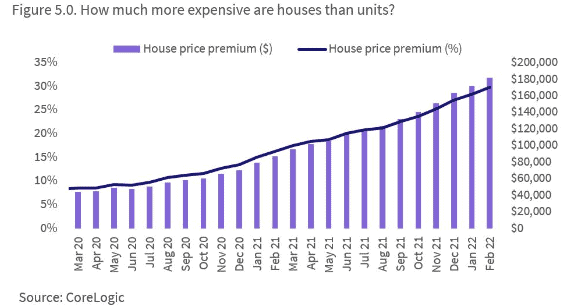

Premium of House Prices compared to Units Skyrockets: The significant impacts of COVID-19 in addition to the buyer pool at the time has contributed to a gap between house and unit values.

Property investors preferring units make a small part of the housing upswing. We are also seeing that detached houses are in higher demand as Australians were spending more time at home through lockdown. Government grants including the HomeBuilder grant may have contributed to the increased detached housing demand.The result? A record high gap between house and unit values.

House values across Australia was 29.8% above the median Australian unit value with the dollar value premium equaling $182,000. March 2020, the dollar premium value equalled $44,000 for houses, 8.5% less.

Property Market Trends to watch for in the latter half of 2022 & beyond

What’s ahead of Property Values?

The rate of property price growth will slow moving forward. Price falls are likely to decrease by the end of the year as the RBA begins a rapid tightening cycle to combat inflation. The cash rate will likely rise to 2.35% by mid-2023, while the market expects it to reach close to 3.25%. Causes include:

- Demand is Waning: There will be considerably fewer purchasers and sellers in 2022, than there were in 2021. While there are always individuals wanting to relocate houses and many have postponed their plans owing to the pandemic, there are only so many buyers and sellers available, which means the demand for properties will drop.

- Many buyers will be restricted by affordability: The impact of low interest rates allowing borrowers to pay more has made its way through the system, with property values now 20% to 30% greater than at the start of this cycle. This was when wages were slow and modest. This indicates that the typical home buyer will not have additional money in their pocket to pay extra for their new home.

- FOMO (Fear of Missing Out) has vanished: Buyers are being more cautious in making deliberate judgments, compared to last year when they rushed into the market.

Emphasis on Neighbourhoods

Now that we have moved from our COVID-cocoons, buyers are now looking to purchase properties that offer increased livability. This means properties with more security, or can ‘evolve’ with their needs. “Liveable” locations will also play a significant role in a buyer’s purchasing habits. Those who can afford it will offer to pay a premium for the ability to work hybrid roles, live within a twenty-minute commute and walk or bike from home. Business services, education and community facilities will also be important considerations.

Rentals will continue to Skyrocket

Australia continues to remain in a rental crisis. At a time of extremely low vacancy rates, rising rental demands will propel rents higher through 2022. This will be compounded as international borders continue to reopen. Increased demand for housing in the coming years will also be exacerbated by the return of expatriates and international students to our cities.

Our Economy will continue to remain Robust

The economy remains in excellent shape, with employment rates at record highs and business and consumer confidence also in favourable positions. However, any indication of runaway inflation may lead confidence to plummet significantly. According to government data released in mid-March, the unemployment rate had fallen to a 50-year low of 4%.

The Australian Federal Election may still have significant impact on the Housing Market

Now that the election has come and gone, we are looking forward to the Labor party implementing its pledge to limit negative gearing for newly constructed houses and reducing capital gains tax deduction on investment properties held for more than a year to 25% from 50%.

Migration to Queensland will continue

Now that our borders have opened up, and given the cost gap and perceived lifestyle advantages, it’s likely that people will continue to move to Queensland in the coming years. Add the long-term benefits of hosting the Olympics and upcoming investments in additional infrastructure, this northern state is looking particularly positive.

Want to learn more about the latest career opportunities in property development or real estate? Contact our specialist recruiters today for more information.